social security tax limit 2021

Your employer would contribute an additional 885320 per. Filing single single head of household or qualifying widow or widower with 25000 to 34000 income.

/GettyImages-576720420-27eaa138a2e144d2b957315f18ef2725.jpg)

Social Security Tax Definition

Maximum earnings subject to the Social Security tax also increased.

/GettyImages-908062776-91d6c9a754fb45ab8de8513244b5a036.jpg)

. If your combined income was more than 34000 you will pay taxes on up to 85 of your Social Security benefits. The maximum amount of Social Security tax an employee will pay in 2021 is 885360. 9 rows This amount is known as the maximum taxable earnings and changes each year.

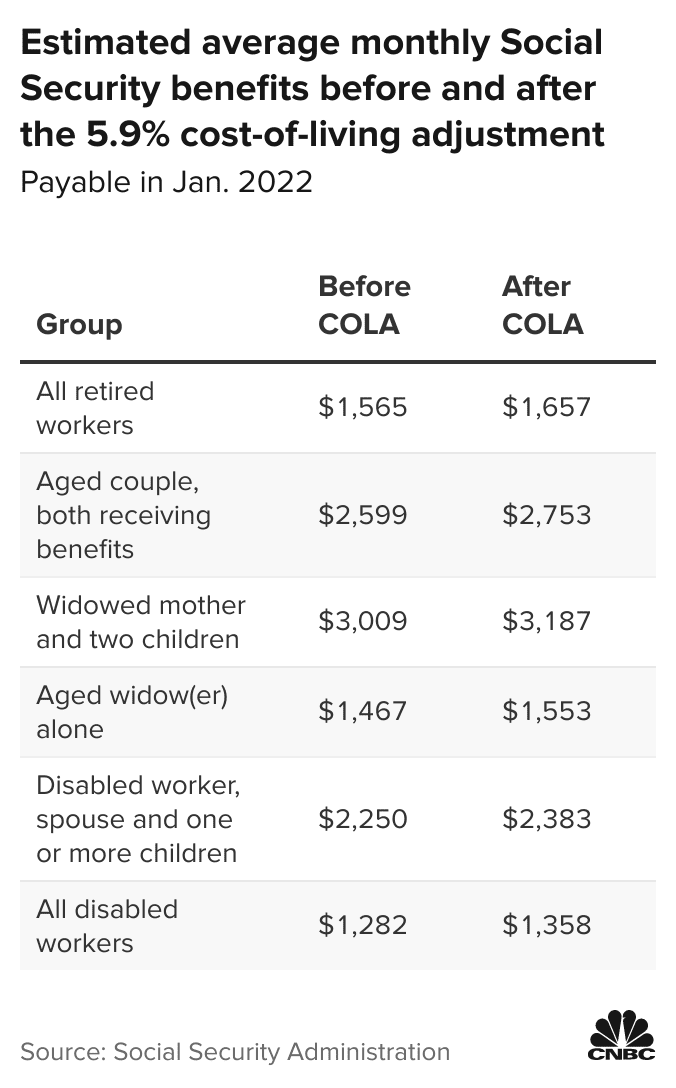

C Taxable pensions wages interest dividends and other. In 2021 the Social Security tax limit is 142800 up from 137700 in 2020. The 2020 COLA for Social Security increased 2021 SS benefits by just 13.

Other important 2021 Social Security information is as follows. Say you earn at least 142800 in 2021. Under federal law people who are receiving Social Security benefits and who have.

Only the social security tax has a wage base limit. Married filing separately and lived apart from their spouse for all of 2019 with 25000 to 34000 income. The Social Security tax limit in 2021 is 885360.

The Social Security taxable maximum is adjusted each year to keep up with changes in average wages. Social Security recipients will get a 59 raise for 2022 compared with the 13 hike that beneficiaries received in 2021. For 2021 an employee will pay.

If youre employed by someone else youll pay 885360 in. As its name suggests the Social Security self-employed. If that total is more than 32000 then part of their Social Security may be taxable.

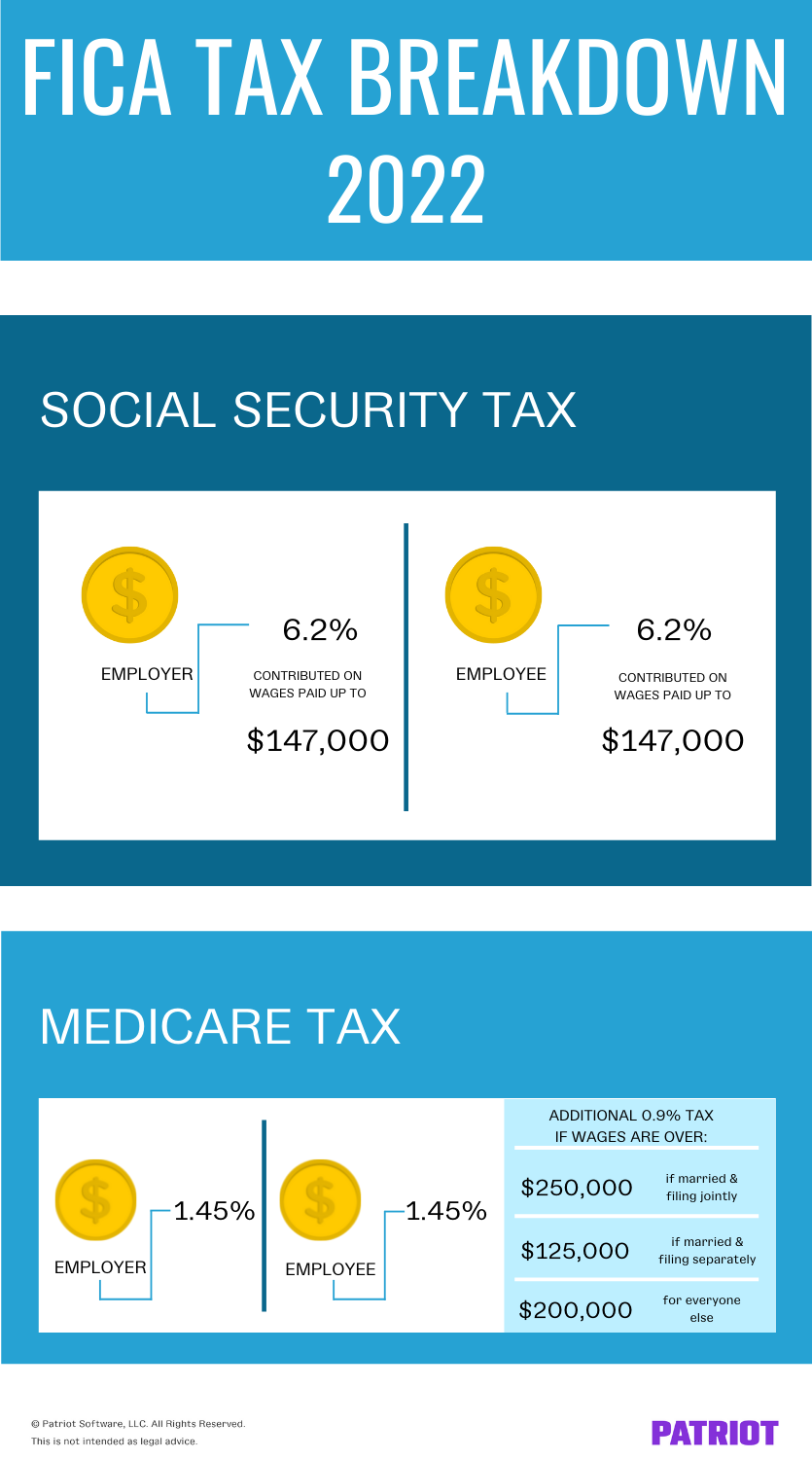

The wage base limit is the maximum wage thats subject to the tax for that year. The Medicare portion HI is 145 on all earnings. Discover Helpful Information and Resources on Taxes From AARP.

D Tax-exempt interest plus any exclusions from income. Fifty percent of a taxpayers benefits may be taxable if they are. Amounts for 1937-74 and for 1979-81.

Social Security recipients will also receive a slightly higher benefit payment in 2021. Also as of January 2013 individuals with earned income of more than in Medicare taxes. 62 Social Security tax on the first 142800 of wages maximum tax is 885360 62 of 142800 plus.

The Medicare portion HI is 145 on all earnings. 62 of each employees first 142800 of wages salaries etc. Half this tax is paid by the employee through payroll withholding.

If you earn 142800 per year in 2021 the maximum youll pay in Social Security taxes is 62 of your income or 885360 per year. Read our free guide discover 6 sources of post-retirement income you ought to know. The tax rates shown above.

The most you will have to pay in Social Security taxes for 2021 will be 9114. Married filing jointly with 32000 to 44000 income. Social Security Tax Limit for 2021.

The same annual limit also applies when those earnings are used in a benefit computation. Ad See Whats Been Adjusted for Income Tax Brackets in 2022 vs. Filing single head of household or qualifying widow or widower with 25000 to 34000 income.

Thats what you will pay if you earn 147000 or more. Employeeemployer each Self-employed Can be offset by income tax provisions. The tax rate for Social Security tax is 62 Both the employee and employer must pay this percentage so the SSA will receive a total of 124 of your wages.

If an employees 2021 wages salaries etc. For earnings in 2022 this base is 147000. Heres what this means.

Fifty percent of a taxpayers benefits may be taxable if they are. Each year the federal government sets a limit on the amount of earnings subject to Social Security tax. Information for people who receive Social Security benefits.

A Amount of Social Security or Railroad Retirement Benefits. Tax Rate 2020 2021 Employee. Wage Base Limits.

If you withhold more than 9114 2022 or 885360 2021 you surpassed the wage base and must reimburse your employee. The employers Social Security payroll tax rate for 2021 January 1 through December 31 2021 is the same as the employees Social Security payroll tax. Filing single single head of household.

Hunter Kuffel CEPF Dec 28 2021. Social Securitys Old-Age Survivors and Disability Insurance OASDI program limits the amount of earnings subject to taxation for a given year. SSI payment rates and resource limits January 2021 in dollars Program aspect Individual Couple.

If that total is more than 32000 then part of their Social Security may be taxable. 145 Medicare tax on the first 200000 of wages 250000 for joint returns. Ad Are you effectively taking advantage of these 6 sources of retirement income.

In 2021 the contribution limit is 885360 142800 X 0062. If youre self-employed youll owe 1770720 in Social Security taxes. So employees pay 62 of their wage earnings up to the maximum wage base and employers.

Individuals earning a combined income of between 25000 and 34000 may be required to pay income tax on up to 50 percent of their Social Security benefits. In 2010 tax and. The other half is paid by the employer.

As of 2021 a single rate of 124 is applied to all wages and self-employment income earned by a worker up to a maximum dollar limit of 142800. This is the largest increase in a decade and could mean a higher tax bill for some high earners. The maximum Social Security contribution in 2022 is 9114 147000 X 0062.

Social Security and Medicare taxes. As a result the Trustees project that the ratio of 27 workers paying Social Security taxes to each person collecting benefits in 2020 will fall to 22 to 1 in 2039. Exceed 142800 the amount in excess of 142800 is not subject to the Social.

This means that you will not be required to pay any additional Social Security taxes beyond this amount. For the 2021 tax year which you will file in 2022 single filers with a combined income of 25000 to 34000 must pay income taxes on up to 50 of their Social Security benefits. The Social Security portion OASDI is 620 on earnings up to the applicable taxable maximum amount see below.

The 2021 tax limit is 5100 more than the 2020 taxable maximum of 137700 and 36000 higher. Then the 50 percent and 85 percent thresholds are applied as follows according to the Social Security Administration. Or Publication 51 for agricultural employers.

For 2021 the FICA tax rate for employers is 76562 for OASDI and 145 for HI the same as in 2020. Refer to Whats New in Publication 15 for the current wage limit for social security wages. Fifty percent of a taxpayers benefits may be taxable if they are.

Married filing separately and lived apart from their spouse for all of 2021 with more than. Taxable maximum amount see below. Learn about our editorial policies.

B One-half of amount on line A. The 2021 Social Security cost-of-living adjustment will not kick in until January 2022. Worksheet to Determine if Benefits May Be Taxable.

IRS Tax Tip 2021-66 May 12 2021 Taxpayers receiving Social Security benefits may have to pay federal income tax on a portion of those benefits. Current thresholds for calculating tax on Social Security.

Social Security Taxes 2022 Are Payroll Taxes Changing In 2022 Marca

What Is Social Security Tax Calculations Reporting More

Medicare Tax In 2022 How Much Who Pays Why Its Mandatory

Full Retirement Age For Getting Social Security The Motley Fool

Social Security Cost Of Living Adjustment Will Be 5 9 In 2022 Biggest Annual Hike In 40 Years

All The States That Don T Tax Social Security Gobankingrates

Social Security Wage Base Increases To 142 800 For 2021

What Are The Major Federal Payroll Taxes And How Much Money Do They Raise Tax Policy Center

The Social Security Wage Base Is Increasing In 2022 Sensiba San Filippo

Increased Wage Inequality Has Reduced Social Security S Revenue Center For American Progress

What Is The Social Security Tax Limit Social Security Us News

Easiest 2021 Fica Tax Calculator

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

Policy Basics Federal Payroll Taxes Center On Budget And Policy Priorities

/GettyImages-908062776-91d6c9a754fb45ab8de8513244b5a036.jpg)

Are Social Security Benefits Taxable After Age 62

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

/GettyImages-963811020-4a28b09314ec43108714573b93e1fcae.jpg)